Unemployment Insurance (UI) benefits are available to individuals who lost their jobs through no fault of their own. The claimants must meet monetary eligibility criteria when applying for UI benefits, one such being the base period. Know what is a base period and calculate your UI benefit amount using our base period calculator for unemployment.

Unemployment Insurance (UI) benefits are available for people who lose their jobs through no fault of their own. When applying for UI, you must have certain monetary eligibility criteria, and one of them is knowing your base period. In this article, we will teach you, what a base period is and how you can figure out your UI benefits with our handy calculator.

Understanding the Base Period

So, what exactly is a base period? It’s the chunk of time where you were working before you lost your job. For most states, this time frame stretches over 12 months and includes the first four of the last five quarters leading up to your claim.

What is a quarter? How many months are there in one?

Ever wonder how the calendar year is split for financial purposes? It’s divided into four parts, (or four quarters) each lasting three months:

Quarter 1: January, February, and March

Quarter 2: April, May, and June

Quarter 3: July, August, and September

Quarter 4: October, November, and December

The base period is key because it helps figure out if you qualify for UI and how much you might get. For this period to count, the employer you worked for needs to be part of the UI system.

Types of Base Periods

You'll find there are two main kinds:

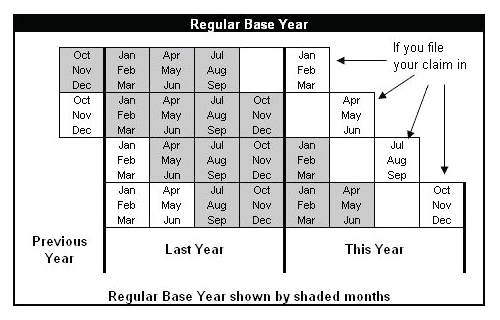

- Standard Base Period: This is the go-to base period used across all states. It looks at the first four of the last five full quarters before your UI claim kicks off.

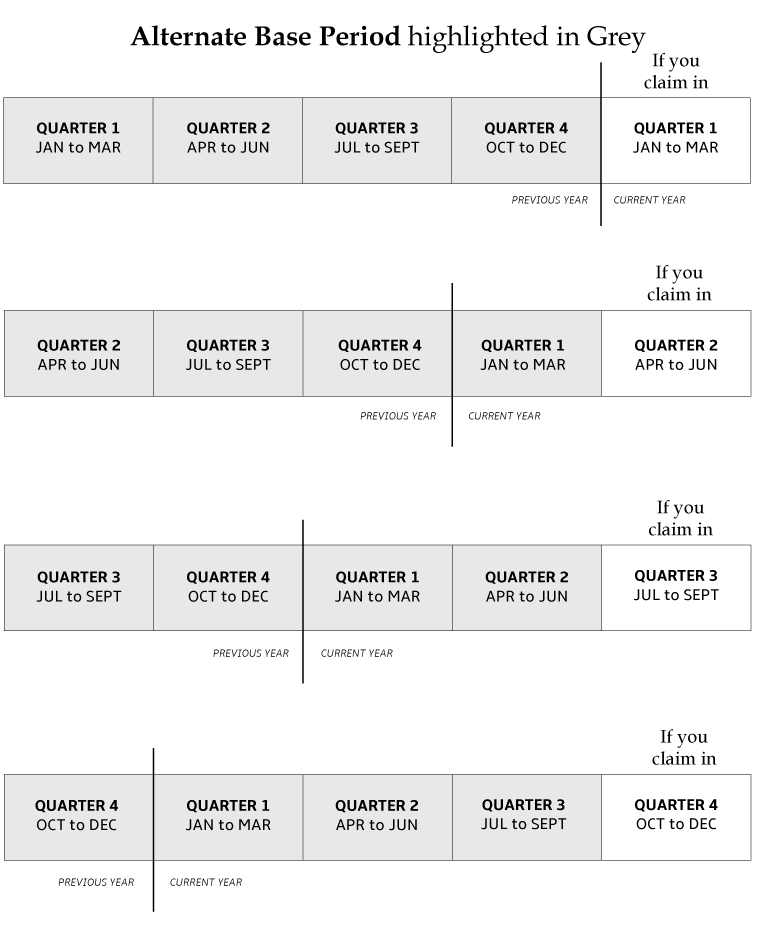

- Alternative Base Period: This one comes into play if the common base period doesn’t show enough earnings. It considers the last four complete quarters right before your claim starts. Not all states offer this option, but it's available in quite a few.

What is the Standard Base Period?

The Standard Base Period is pretty straightforward. It’s widely used in all states and includes those crucial months leading up to your UI application. It comprises the first four of the last five completed calendar quarters preceding a UI claim’s starting date.

How to find Standard Base Period?

Wondering how to determine the Standard Base Period for your UI claim? It’s simple. If you file a claim between January and March 2024, your base period will run from October 1, 2022, through September 30, 2023. This 12-month stretch is crucial for assessing your eligibility.

What is the Alternative or Alternate Base Period?

Not enough wages in the Standard Base Period? No worries. You might still qualify for UI benefits with the Alternative Base Period. This option considers the last four full quarters right before your claim starts. You might need to provide some additional documents like recent earnings, pay stubs, and wage verification.

Keep in mind, this option isn't available everywhere. As of 2018, 39 states had this option in play.

How to find Alternate Base Period?

If you're filing your claim between January and March 2024, your alternative base period would be from January 1, 2023, to December 31, 2023. This 12-month period will be reviewed to see if it can qualify you for the benefits you need.

What happens if you had multiple jobs during the base period?

What if you've juggled more than one job during the base period? Here’s how it works: the people in charge will look at hours, wages, and your job history to figure out which was your main gig and which were just side jobs. They use the income from all your jobs to decide if you qualify for UI, but you only get benefits if you lost your main job.

Also, if you quit a side job less than eight weeks before you're eligible for UI, your benefits might be reduced. This is called a constructive deduction.

How to file interstate & multi-state claims?

Worked in different states? If you've worked in one state but now live in another, you'll need to follow the rules of the state where you worked when filing for UI. You can file your claim online or by phone, depending on what the state allows.

If you’ve worked in several states, pick any one of them to file your claim. That state will reach out to the others to gather your wage info so they can figure out your base period.

How to file for UI benefits if you are relocating to another state?

Planning to move states for a job? Make sure to start your UI claim before you go. File through an online portal and keep them updated about your move to avoid any delays or issues with your claim. Your UI claim will need to be transferred to your new state.

Base period rules can differ from one state to another. If you're not sure what applies where you are, get in touch with your local unemployment office. They can explain the criteria and help you use their calculator to see what you might be eligible for based on your base period wages.