Unemployment benefits in North Carolina are available to eligible workers who have lost their employment through no fault of their own. These benefits are designed to provide temporary financial assistance while claimants look for new work.

If you qualify for NC unemployment compensation, you can receive weekly payments for 12-20 weeks.

North Carolina UI Benefits Calculator

The North Carolina Unemployment Benefits Calculator helps you estimate your UI weekly benefits amount.

Calculate Your North Carolina Unemployment Benefits

See our North Carolina unemployment calculator to estimate your UI benefit payments.

North Carolina Unemployment Calculator

Eligibility for UI Benefits In North Carolina

North Carolina Division of Employment Security Commission has set certain criteria that you need to meet to claim weekly unemployment benefits.

Monetary Eligibility

One of the requirements for NC unemployment eligibility is that you must have worked and earned enough during the previous year.

The North Carolina Department of Employment Security examines your work over the past year, often referred to as your base period. To qualify for unemployment benefits, you need to have earned at least $780 in the final two quarters of your base period. The sum of your wages during your base period must be at least six times the “average weekly benefit amount,” which is the dollar amount that unemployed North Carolinas receive on average.

Your base period usually comprises the first four of the last five full calendar quarters before you claimed unemployment insurance benefits.

After applying for UI benefits, you will receive a Wage Transcript and Monetary Determination. This letter will contain all the necessary information about you, including all the employers you’ve worked for and the wages you’ve received. The letter will also provide your estimated weekly benefit, maximum benefit amount, and the number of weeks you will receive benefits. You are expected to read this letter and verify if your wages are correct.

Find out more about eligibility requirements

Job Separation

After establishing monetary eligibility, the next step is to qualify for benefits based on the reason you became unemployed.

The North Carolina unemployment insurance program is available if you lost your job through no fault of your own. If you’re an unemployed worker who was laid off, you can potentially be eligible for unemployment insurance benefits, but if you quit your job without good cause or were fired for misconduct, you may not be eligible.

The NC DES will verify your job separation claim with your former employer. If you and your ex-employer disagree with the reason for your job separation, your eligibility for benefits may be withheld during the appeals process.

Maintaining Eligibility

To remain eligible for unemployment benefits in North Carolina, you must continue to meet specific requirements each week. This includes being able and ready to work, actively seeking employment, and performing weekly work search activities. You are required to file a weekly claim and submit your weekly certification before your payment will be sent.

To make sure that you receive your weekly benefits every week without any hurdles, make sure to adhere to the following points:

- You must be available to work at all times in the weeks you receive monetary benefits.

- You are mentally and physically able to work.

- You must report any income or job offers

- You must register with the North Carolina Division of Workforce Solutions for work at NCWorks online.

- You must actively search for work and make at least three new job contacts each week

- You must follow the rules and prevent yourself from committing NC unemployment fraud by providing false information or by withholding important information.

Learn more about NC job search requirements

How to apply for UI benefits in NC

To apply for unemployment benefits in North Carolina, you will need the following documents:

- Your Social Security Number.

- Details from your most recent employer about separation, vacation, or severance pay you received, will receive, or are entitled to receive.

- Details regarding any retirement pay (gross monthly amount of pay along with proof).

- Your bank routing number and account number if you would like unemployment payments directly deposited into your bank account. If you do not select direct deposit, payment will be placed on a DES-issued debit card.

- Your work history for the past two years (employer name as it appears on your check stub, employer’s payroll and physical addresses, telephone number, employment dates, rate of pay, and reason for separation from each employer).

You must file your North Carolina unemployment claim online. You can apply for NC unemployment insurance benefits 24 hours a day, 7 days a week. If you don’t have internet access, you can use the computers at your local NCWorks Career Center or call the Customer Support Center for additional assistance.

Apply for NC unemployment benefits

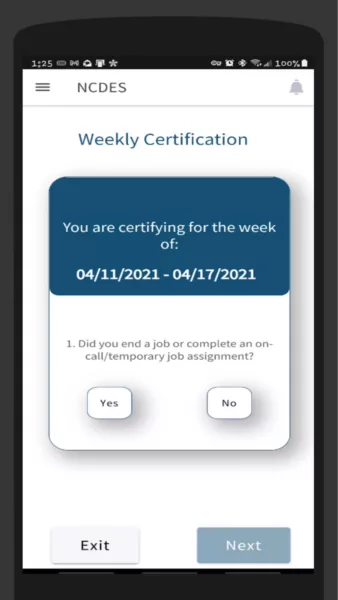

How To File Weekly Claims

Before you can collect payment, you must certify your eligibility each week. You can file your weekly claims through the DES website. If you don’t have access to a computer, you can also certify your weekly claims by calling the customer care number – 1-888-737-0259. Each week, you will be asked to verify that you are willing and able to work. You must report any job offers or earned wages. To meet the weekly work search requirement, you must document three new job contacts each week during this process. Payments are usually sent within 48 hours of submitting your request for payment.

Learn how to claim weekly benefits

Things To Know After Filing An Application

You are expected to follow certain guidelines after filing for unemployment benefits in North Carolina. Not following these guidelines can create problems for claimants and may result in a denial of your UI benefit.

Overpayments And Collections

An overpayment occurs when you receive benefits to which you are not entitled, either inadvertently or through willful misrepresentation. Examples of overpayment include undisclosed earnings, fake documents submission, not reporting your new job or your new source of income.

North Carolina overpayments fall into two types – Fraudulent and Non-Fraudulent. A fraudulent overpayment occurs when you knowingly provide false or misleading information to get benefits or to extend the benefits weeks. The Division of Economic Security takes cases of fraud very seriously. NC unemployment fraud cases that exceed $400 can be prosecuted as a felony in the state of North Carolina. If you receive an overpayment, you must pay it back (learn more).

Benefits Extension

The state offers a UI benefits extension when the unemployment rate is too high or there is an economic downturn. Regular unemployment compensation in North Carolina lasts 12-20 weeks, depending on the seasonal unemployment rate in the state. Disaster Unemployment Assistance may be available in the event of a natural or man-made disaster. Learn more about extended UI benefits in NC.

Job Training Assistance

North Carolina offers several job training programs aimed at supporting unemployed workers and preparing them for new employment opportunities.

On-the-Job Training programs provide practical, hands-on experience, so eligible workers can develop specific skills needed in the workplace. There is also the Customized Training Program, which helps businesses design training that meets the unique needs of employers and their workforce.

The Incumbent Worker Training program is a service for employers that enhances the skills of current employees. There are also a variety of apprenticeships available that provide structured training with an employer in a specific trade. Additionally, the Workforce Innovation and Opportunity Act (WIOA) supports workforce development activities, including job search assistance and training services, for individuals facing barriers to employment.

Find job training opportunities in NC

North Carolina unemployment contact information

If you have questions about your claim for NC unemployment benefits, you can call the unemployment claims center.

If you need assistance finding a new job, including help with resume writing, job interview preparation, current labor market information, and job training programs, visit your local NCWorks Career Center.

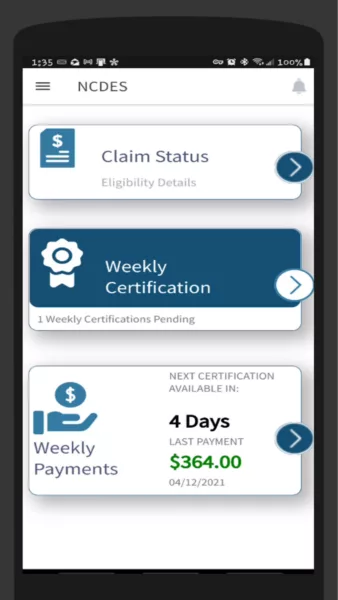

NCDES Mobile App

Available on Google Play Store and the Apple App Store.

The North Carolina DES has created a mobile app for those claiming unemployment benefits. The app allows you to file your weekly certifications for benefits. Once you’ve completed your certification, you’ll receive a confirmation number right on your device.

With the NCDES mobile app, you can check the status of your claim, see your weekly benefit amount, and view the status of your payments. The NCDES mobile app also provides access to important documents and notifications from the DES.

Comments are closed.